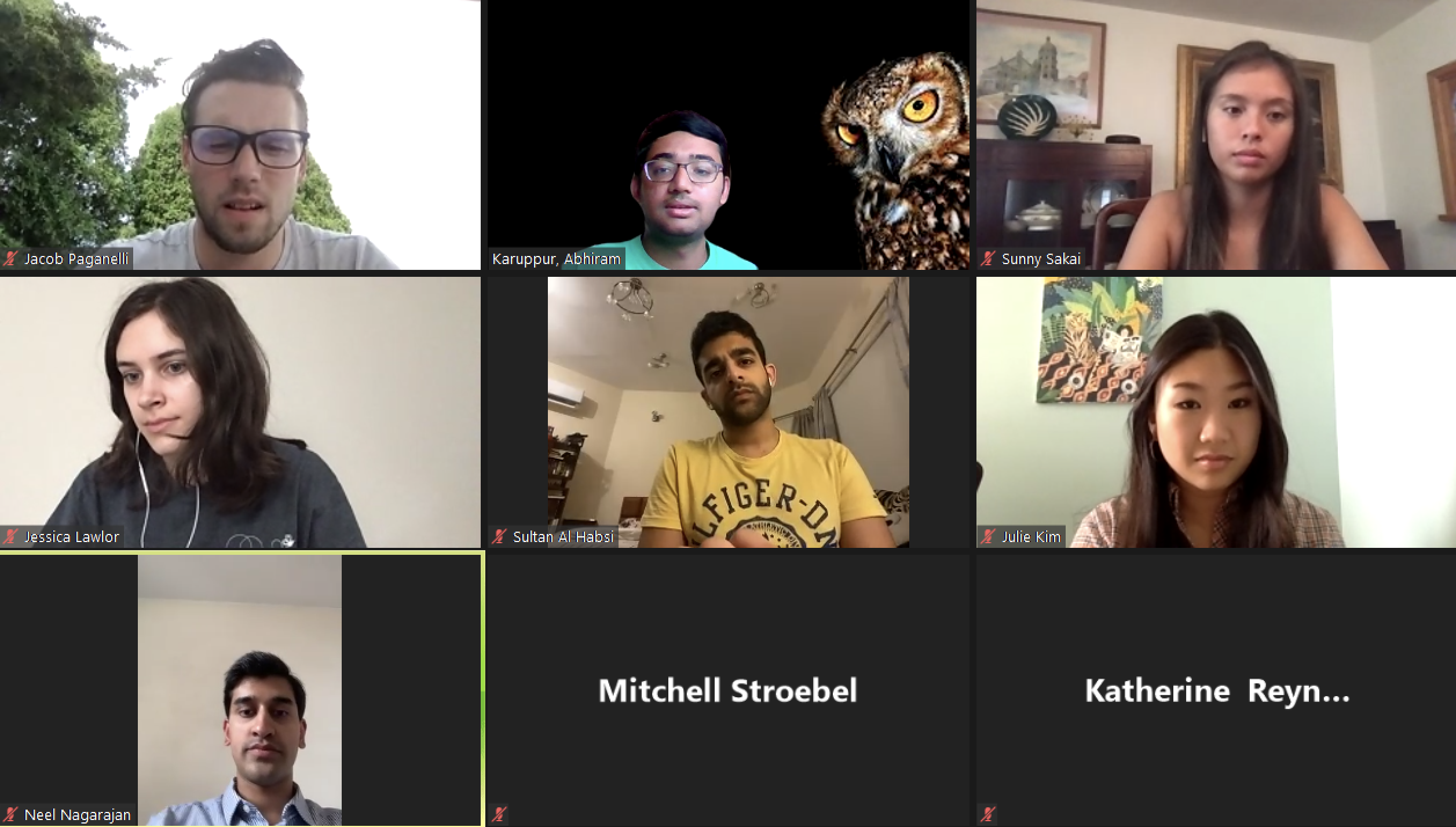

When Princeton’s Center for Career Development asked Abhiram Karuppur ’19 if he’d participate in online “coffee chats” with current undergraduates after COVID-19 disrupted the spring semester, the J.P. Morgan investment banking analyst was happy to oblige. He remembered how important internships had been to his own professional development, and he realized that many current students had been forced to scrap their summer plans. At the very least, he could answer their questions about his industry.

“One of the things I found most valuable when I was a student was being able to talk to other Princeton people who had just graduated or were slightly older, who worked in jobs that I thought were interesting,” said Karuppur, who’s been working remotely from Central Jersey during the pandemic. “Back then, I wanted to know more about what they do on a day-to-day basis and what they did to prepare themselves for that job.”

One of the students he met for online coffee was Jessica Lawlor ’21. Her summer internship at the U.S. Treasury has been cancelled, and she had yet to secure a backup plan. Though strangers, Lawlor and Karuppur hit it off, and Karuppur offered to mentor her, to provide some of the guidance usually associated with an internship.

“Then I mentioned that I knew a lot of other people in my sphere that had also lost internships or had difficulty finding them,” Lawlor said. “And I asked, ‘If you can mentor one person, would you potentially be interested in mentoring several?’ And he said, ‘Yes.’”

Karuppur did more than just become a mentor. He set out to build his own virtual finance mentorship class program that would replicate the internship experience and teach students the material that they would have learned. With an assist from Professor Smita Brunnermeier, executive director of economics undergraduate studies, who sent an email to students advertising the project, more than 20 other students signed up for his summer program.

“At Princeton, one of the inside jokes is if you get 50 signups for something, only 10 people actually show up,” Karuppur said, with a chuckle. “That’s kind of the mentality I had going into this — I thought maybe five people would be interested — but I’ve actually been pretty impressed with their interest and commitment.”

Every Friday afternoon Karuppur and the students log online to discuss a new finance concept and ways to apply it to tasks that finance professionals do on a daily basis.

“Honestly, I didn’t really have a template to go off of,” said Karuppur, describing his program. “One of the ways I structured it was thinking about what I do in my current job, and what are some of the tasks that I do that can, (A) easily be taught, and (B) can easily be put together by someone sitting at home. Finance, actually, is the perfect industry to do assignments and to learn the knowledge without actually having to come into an office and physically be in person.”

Karuppur leads the weekly discussions and prepares exercises so that the students become familiar with key terminology and analytic methods. For the second part of the “mentorship class,” the students pair up for a project where they use these techniques and skills to put together a comprehensive presentation. Each team selects two companies that they’re interested in and crunches the financial numbers to see if they might have potential as a merger or buyout candidates.

“The last session will be where they present their deliverable to the group, where they’ve done the analyses, consolidated everything, come up with a hypothesis, and come up with a conclusion,” Karuppur said. “That’s really the end goal: that they have something tangible that they’ve done, something they can point to during a job interview and say, ‘This is what I did.’”

Online attendance has been strong, and Karuppur fields student emails about his topics during the week, which he thinks indicates they’re engaged and working on their team projects independently.

“People were really excited to be there,” Lawlor said. “The people that I already knew thanked me after the first meeting for helping to set it up and said that they really enjoyed it. I think most people were so grateful to have something, even just once a week for an hour, just some kind of experience, some kind of enrichment that could help them in the summer.”

For Lawlor, the weekly sessions and research helped her decipher the forces that drive our economy.

“I think finance is very shrouded in mystery for a lot of people; that we don’t really know what Wall Street is doing or how they do it,” Lawlor said. “But now when I hear about a merger or an acquisition, I have an understanding of what that means or why that was done. This summer has been helpful for understanding the economy at large.”

For Karuppur, being a virtual mentor has required hours of after-work planning, building a structured curriculum from scratch and then tweaking it slightly over time as he learned what worked best. But he would do it again in an instant.

“When I was at Princeton, one of the most valuable things that I found about the school was the alumni connection to the current student body,” he said. “It’s beyond loyalty; it’s more of a duty. A lot of people at Princeton feel like alumni have really stepped up for them and helped them get to where they are. And there’s this sense of, of course you have to pay back, right?”